GFN- (Beijing) China's silver inventories have been nearly depleted as exports surged in October, compounding a modest 3.55% month-on-month decline in domestic production and setting the stage for tighter market conditions ahead.

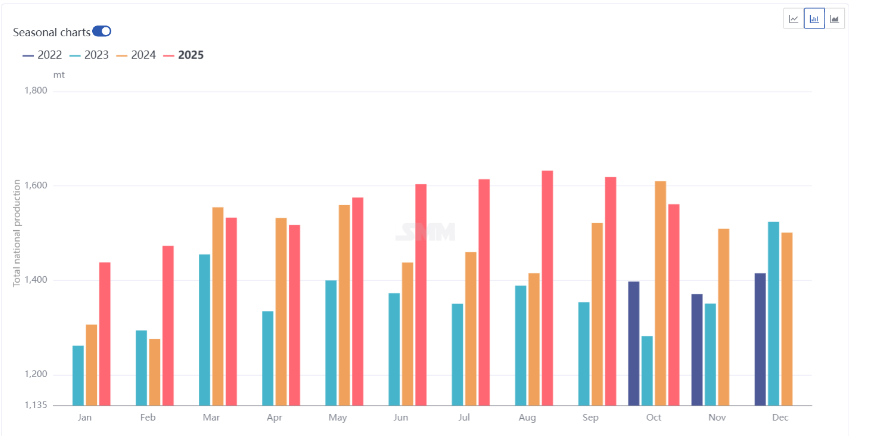

Silver output from key producing provinces-Henan, Yunnan, Shandong, and Zhejiang-fell modestly in October as maintenance shutdowns at copper smelters and end-quarter stock audits curbed supply. While lead smelters sustained by-product output thanks to strong refining margins, disruptions at copper facilities and lower raw material grades at lead-zinc operations in Guangxi, Gansu, and Inner Mongolia point to further reductions in November.

GoldFix is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The sharper story however, is unfolding on the inventory side. Since late September, smelters have diverted a larger share of production abroad after export windows reopened, cutting domestic allocations to long-term contract minimums. The resulting short squeeze overseas spilled into China's spot market, with smelter inventories plunging by roughly 50% month-on-month by end-October. Spot premiums for silver ingots climbed to 30-50 yuan per metric ton, reflecting scarce availability.

Silver Squeezed: Planes Headed to London To Cover Shortfall

For more than a century, London has served as the hub of global precious metals trade, where benchmark prices are set and vaulted bars circulate among a tight network of banks. Secure trucks once handled those flows daily. Today, cargo planes are stepping in. Traders are reportedly booking transatlantic freight to move bulky silver bars from New York to London, paying rates typically reserved for gold to capitalize on the premium in the London spot market.

Market sources indicate some producers still plan to withhold spot sales in early November, despite expectations that easing London liquidity strains and narrowing export margins could restore domestic circulation later in the month. The near-term picture remains one of tightening supply and thin inventories across China's silver sector.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.