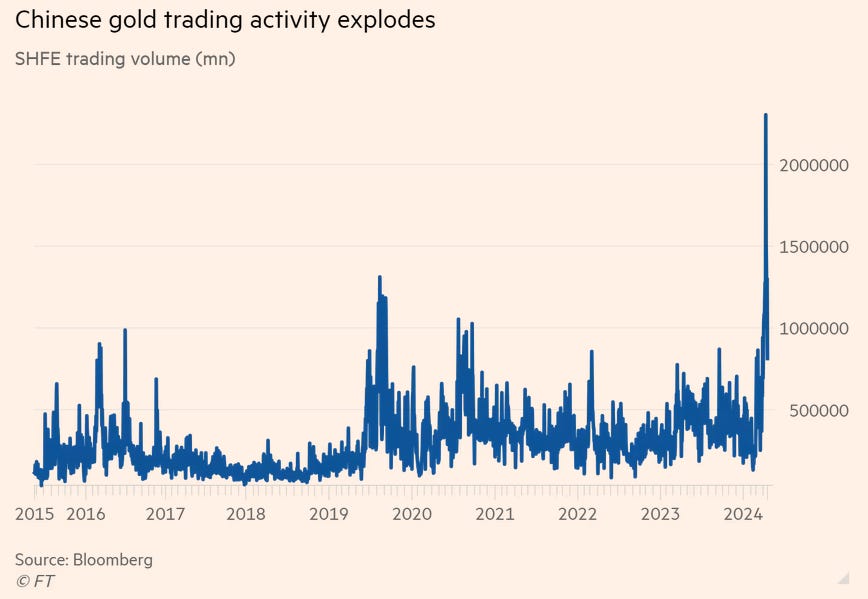

Ever since gold's bull market took off in the spring of 2024, I've been tracking a fascinating phenomenon: Chinese traders on the Shanghai Futures Exchange (SHFE) have played a significant role in driving each surge of the bull market, while Western investors have been late and hesitant to join in. You can learn more about this phenomenon from a Financial Times article and a Bloomberg article, though both are behind paywalls.

Because of that, I've been paying close attention to the gold futures contract traded on the SHFE and performing technical analyses on it, as well as monitoring its trading volume to get an idea of when the next surge might begin. I will do that today, and I can already see a setup that is likely to lead to the next rally.

As I've been showing in recent weeks, a triangle pattern has been forming in gold. This marks the third such pattern in the past year. The previous two, which appeared in the winter of 2024 and the summer of 2025, both resulted in powerful surges. Given that history, I am now watching the current pattern closely to see if it will lead to a similar move. Notably, the same triangle is also forming in SHFE gold futures, where a breakout has yet to occur.

I am now watching the triangle in SHFE gold futures along with trading volume, waiting for a breakout that will signal gold's next rally is about to take off, not just in China but worldwide. In addition to a breakout in Shanghai gold futures from its triangle pattern, I am holding out for a breakout above the 1,000 yuan per gram resistance level because breakouts from horizontal resistance levels are much more reliable and meaningful than breakouts from diagonal resistance levels such as the top of the triangle pattern.

It is very important to see volume surge upon both the breakout from the triangle and the move above the 1,000 yuan resistance level for confirmation, because that means the breakout is far more likely to succeed rather than fizzle out, as I explained in my detailed tutorial yesterday.

One of the key features of gold's initial breakout in March 2024 was the surge in trading volume on the SHFE, as highlighted in the Financial Times article from that period titled "Chinese speculators super-charge gold rally." The volume chart below is taken from that article. This is why monitoring trading volume in SHFE gold futures is so important.

The Financial Times article also showed how open interest in SHFE gold futures surged as speculators piled in, a behavior that is likely to repeat if the current triangle pattern breaks out successfully. However, open interest is more difficult to track for those outside of China.

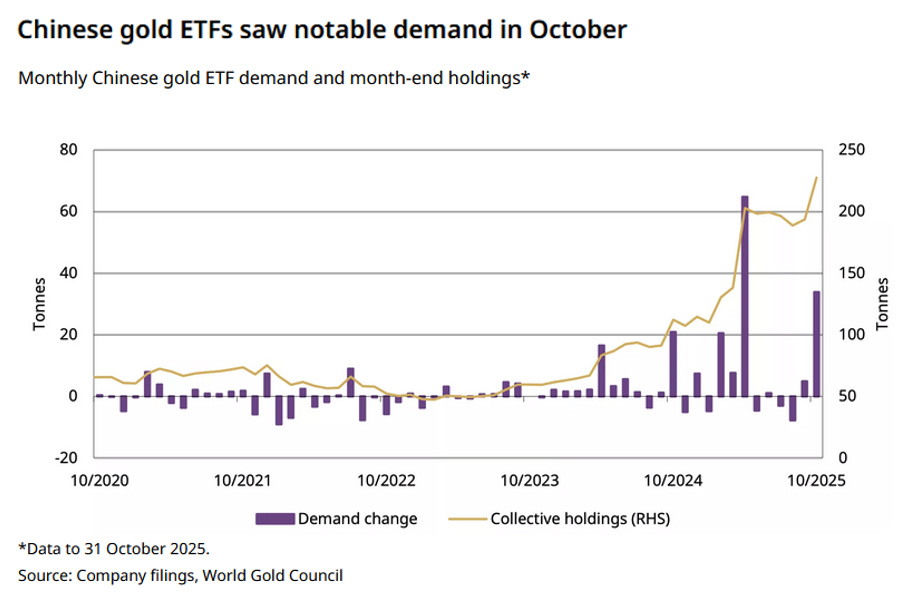

The Chinese are going all in on gold across all levels of society, and it's not just through the futures market but also through exchange-traded funds (ETFs). The latest data from the World Gold Council shows that gold ETF buying has surged in waves during the bull market of the past couple of years, and this buying is likely to play a major role again once the current triangle pattern breaks out.

One way to gauge whether China is taking the lead in driving gold's bull market is by comparing the domestic gold price in China to the international price. When the Chinese price trades at a premium, that is a clear signal. At the moment, the two prices are roughly equal, but if there is a strong breakout from the triangle pattern in Shanghai gold futures and speculators rush in, as they have done several times over the past couple of years, that should push the China gold premium higher.

In addition to their long-standing cultural affinity for gold, Chinese investors have shown an unusually strong appetite for it in recent years due to the country's persistent deflationary economic crisis, which shows little sign of easing.

This crisis was triggered by the collapse of a massive real estate bubble and can be seen as China's equivalent to the 2008 Great Recession and Global Financial Crisis that followed real estate busts in the United States and Europe. The downturn has wiped out at least $18 trillion in household wealth, shaken investor confidence in property and stocks, and driven many toward the time-tested safe haven of gold.

China's deflationary crisis can clearly be seen in the country's government bond yields, which have collapsed to record lows. Gold becomes more attractive in low-interest-rate environments like China's, as the opportunity cost of holding it diminishes.

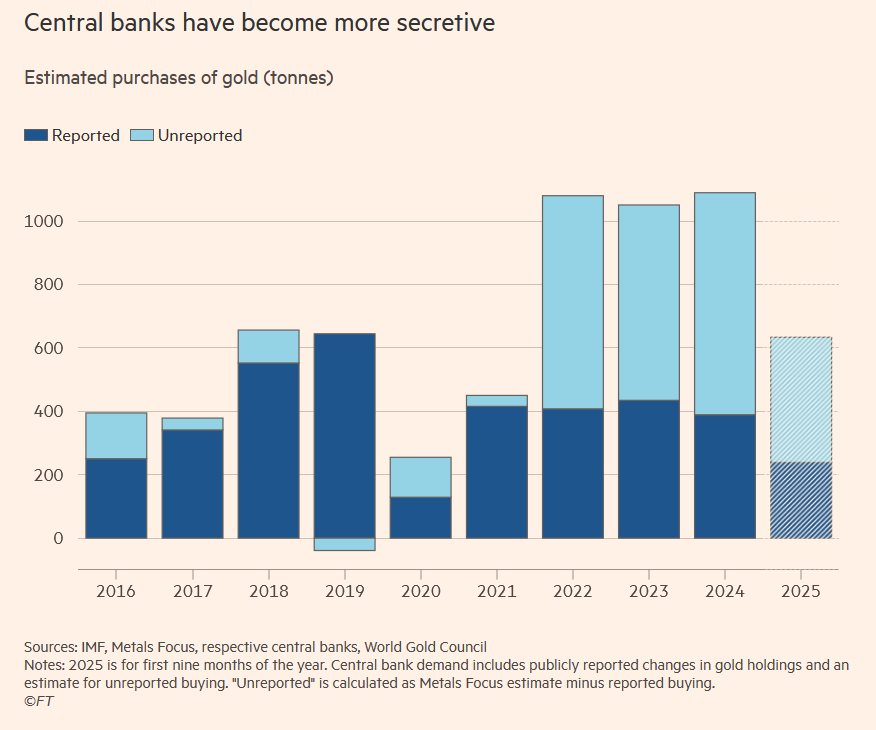

It's not just ordinary Chinese citizens buying gold aggressively; the central bank is also a major buyer. In fact, the People's Bank of China (PBoC) is significantly understating its gold purchases in its officially published statistics. This is something I have pointed out before, and it has recently been reported in mainstream news. The central bank is estimated to be buying up to ten times more gold than it publicly reports.

The chart below shows the official gold purchases reported by the PBoC (dark blue) compared to the estimated actual purchases made through unofficial channels (light blue):

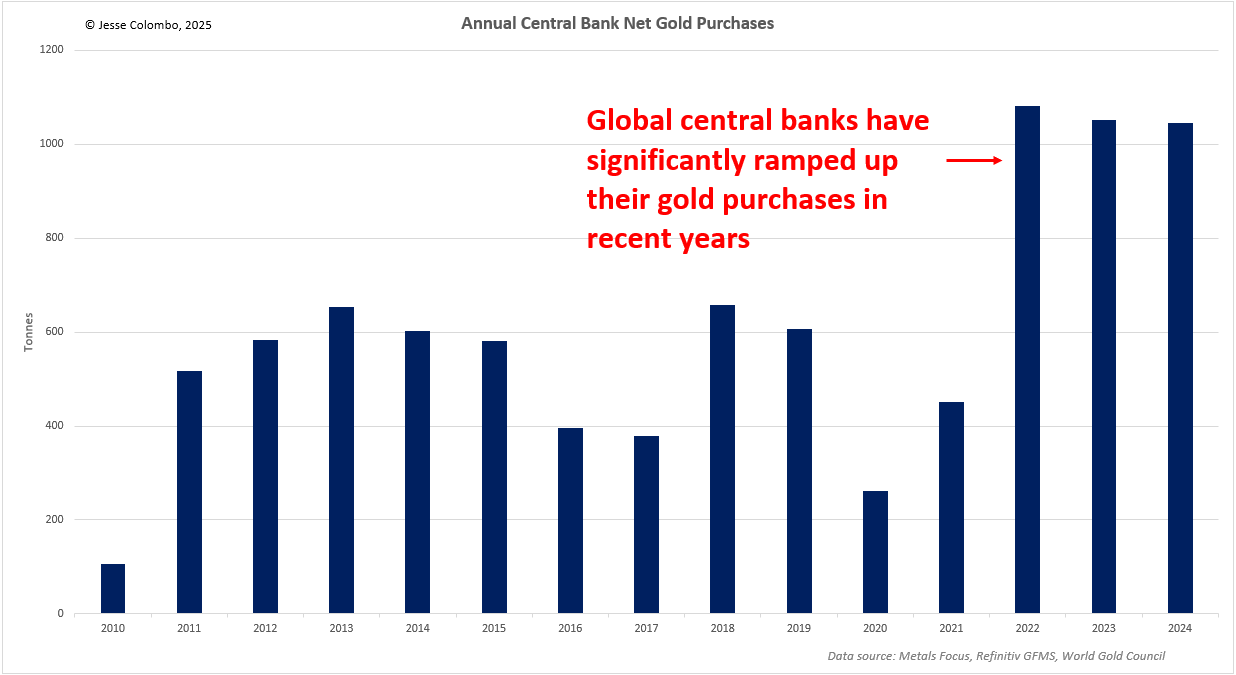

China isn't the only central bank that has been aggressively accumulating gold in recent years. Other emerging market countries, including Poland, Turkey, and Kazakhstan, have also stepped up their purchases, with total buying reaching just above 1,000 metric tonnes per year since 2022. This is roughly double the pace of previous years.

The increase has been driven by a desire to diversify reserves away from fiat currencies and sovereign debt, as government debt levels continue to soar, as well as by the wake-up call that followed the West's freezing of approximately $300 billion in Russia's central bank foreign reserves after its invasion of Ukraine in February 2022.

As I wrote about recently, J.P. Morgan Private Bank cites this continued aggressive accumulation of gold by emerging market central banks as one of the major forces that will drive gold above $5,000 an ounce in 2026, and I also share that view.

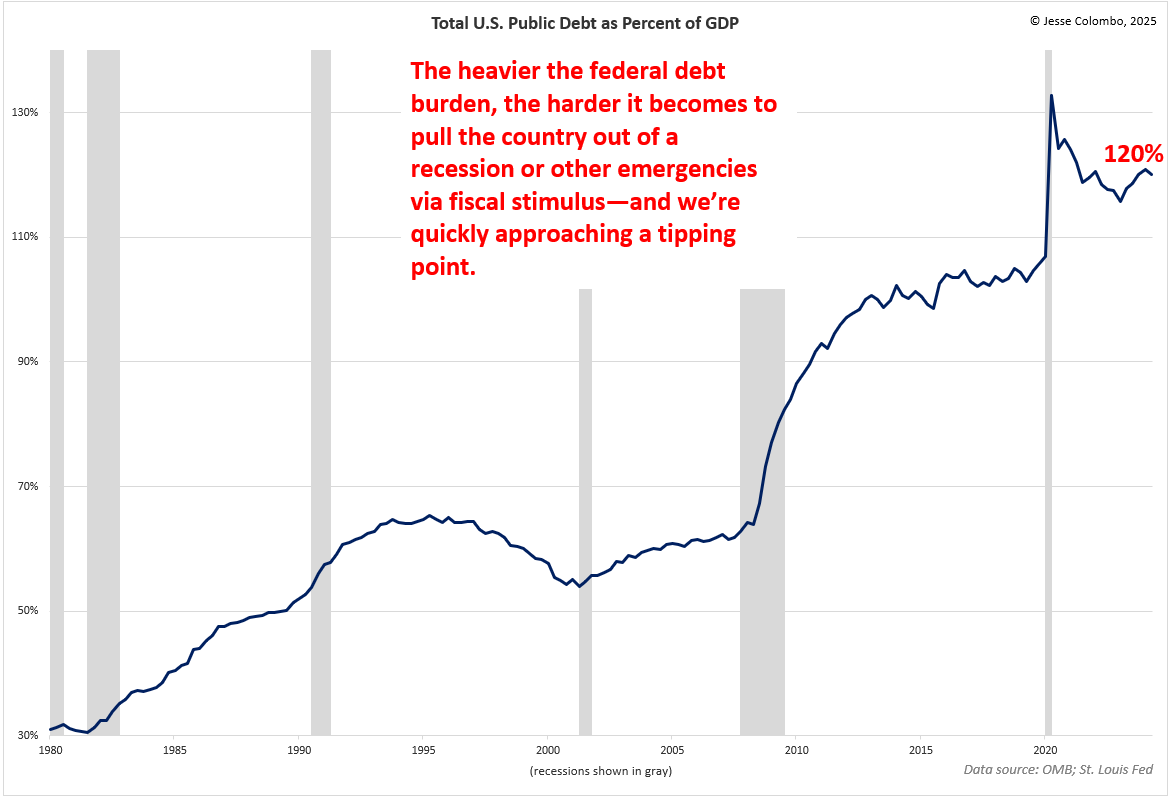

It's entirely reasonable that central banks are moving to diversify their reserves away from rapidly devaluing fiat currencies and the sovereign debt of countries like the United States, which now carries the highest debt burden in its history at 120% of GDP, apart from a brief spike during World War II.

This is not just an issue for the United States; many other wealthy nations are in the same situation. It makes perfect sense to exchange those increasingly risky assets for the safety of gold. Individual investors would be wise to follow the lead of emerging market central banks, who clearly understand that something is wrong.

In summary, Chinese traders on the Shanghai Futures Exchange (SHFE) have played a key role in driving gold's bull market over the past two years, with their aggressive buying activity arriving in powerful waves. Their influence can be tracked by monitoring the price and volume of the SHFE gold futures contract, which is currently consolidating within a triangle pattern. Once that pattern breaks out with strong volume, it will be a clear signal that gold is set to resume its rally and is likely to reach and surpass $5,000 in short order.

If you've enjoyed this report or have any questions, comments, or thoughts, please give this post a like and share your thoughts in the comments below-I'd love to start a conversation and hear your perspective.

Source https://thebubblebubble.substack.com/p/chinese-traders-key-to-next-gold

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.