Platinum & Palladium

Platinum prices are high enough to begin to turn the gears of supply rebalancing but this will take time and, in the interim, we still see a deficit market and a further rally in gold supporting platinum prices to average $1,670/oz in 2026.

In the near-term, tariff risk is most acute in palladium, which will continue to drive upside to prices in the coming months. Beyond this, however, we still see a palladium market where structurally weaker demand growth is expected to bring the market back towards balance by 2027, pressuring palladium prices back towards $1,150/oz by the end of 2026.

Platinum: Higher for longer before the gears of supply rebalancing gain momentum. With prices oscillating between $1,500/oz and $1,700/oz, platinum has entered a bit of a no man's land from a fundamental perspective. By this we mean that prices, after rebasing higher this year, are now high enough to incentivize greater mining capex spending in South Africa to eventually pull platinum supply out of its forecasted multi-year decline. However, this isn't going to happen quickly and will likely take multiple years. In the interim, greater scrap growth at higher prices will help, but it's not enough and we still see a ~400-600 k oz deficit platinum market persisting through 2027. So while higher prices are likely beginning to turn the gears of rebalancing, this continued deficit in the coming years, combined with further forecasted gains in gold and silver and near-term tariff uncertainty, leaves the balance of risk to platinum prices to the upside and we now see platinum averaging around $1,670/oz in 2026.

Palladium: Upside tariff risk is most acute in palladium but longer-term we still see prices fading lower as demand structurally rolls over. Palladium prices have risen sharply since October, riding on platinum's push higher as well as tightening liquidity and US import tariff uncertainty. Of the precious metals we cover, the risk of tariffs being enacted in the coming months (see below) is highest in palladium given that it is included in both the Section 232 critical mineral investigation as well as a concurrent Russian anti-dumping investigation. This heightened degree of tariff risk will likely continue to drive palladium prices higher over the near-term in our view. However, we see palladium fundamentals being quite different than platinum as we look over the coming years as structurally weaker demand growth brings the market back to balance by around 2027. Hence, following a further push higher in the near-term, once tariff uncertainty fades, we ultimately still expect palladium prices to lose ground again, ending 2026 at a 4Q26 average of $1,150/oz and averaging $1,344/oz for next year as a whole.

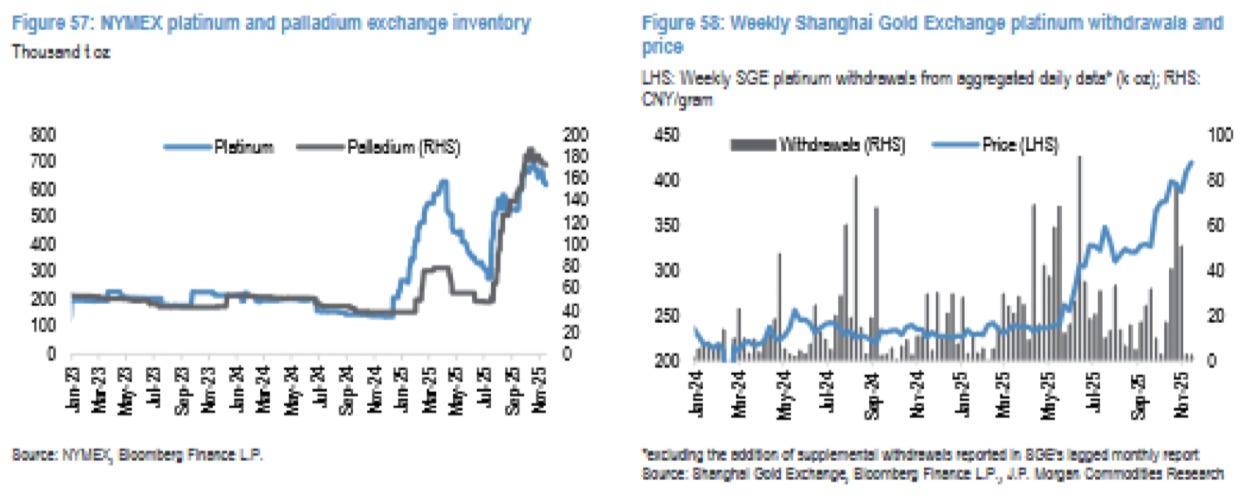

Tariff uncertainty strains London liquidity. Both platinum and palladium are included in the pending Section 232 critical minerals investigation and could potentially be subject to US import tariffs. Similar to silver, this risk of tariffs has driven a large transfer of metal from London to New York, reducing physical liquidity as market participants are reluctant to ship metal from the US ahead of any clarity on tariffs (Figure 57). This bullish illiquidity has been most acute in platinum throughout this year, as China's pull on metal earlier this year and more recently ahead of the 01 Nov end to platinum VAT rebates has strained an already very tight physical market in London (Figure 58). While a clear tariff exemption for platinum could quickly restore liquidity in London, posing a near-term setback for platinum prices, continued uncertainty or the announcement of tariffs would keep liquidity in London constrained with any further pull on metal from London-for example from the launch of futures trading on China's Guangzhou Futures Exchange on Nov 27-continuing to drive upside price volatility. As mentioned above, the upside price risk of tariffs is likely most acute in palladium into 1H26 in our view given multiple investigations and a more significant US production presence that has struggled in the last few years. We think this will continue to drive upside to prices in the near-term, however, once flows adjust with eventual greater tariff clarity, we do think this support will ultimately fade.

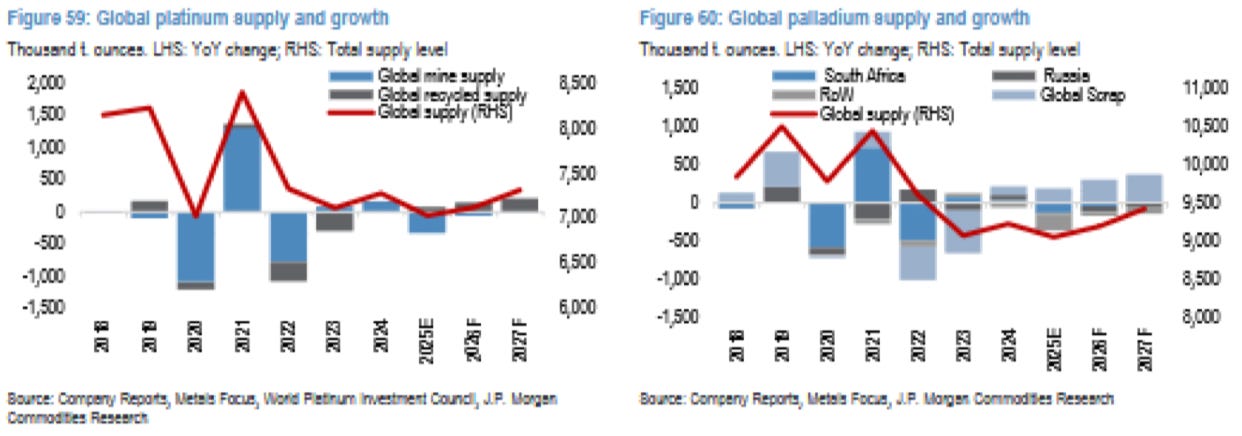

Despite improved producer margins, a return to mine supply growth will still take time. Mine supply across the PGMs is still slated for a decline in both 2026 & 2027, with platinum and palladium mine supply forecast to decline by -1% and -3% yoy next year, respectively. Even though producer margin pressures have eased given the rise in platinum prices this year, we still see limited mine supply growth prospects in the near-term. This year alone, platinum mine supply is estimated to contract by -6% yoy in South Africa amid heavy rainfall in 1Q25 which caused flooding across the mines and led to operational difficulties. While higher prices this year and throughout our forecast horizon take the pressure off producer margins and are likely to be high enough to allow greater sustaining and expansion capex spending, it still likely won't materially alter the overall supply picture in the coming years, as prolonged underinvestment in the sector has led to a weak project pipeline which will take time to refill.

South African platinum mine supply is forecast to decrease by -2% yoy next year and be flat in 2027 (Figure 59). Looking beyond South Africa, Russia's platinum supply is also expected to decline in 2026/27, falling by 2-3% yoy, while Zimbabwe is the only region recording meaningful growth in the next few years as we estimate 7% yoy growth in 2026 and 1% yoy in 2027. The supply outlook is very much similar in palladium where we also expect a downward trend in the coming two years. We forecast -3% yoy decline in palladium mine supply for 2026 and -2.4% yoy in 2027, mostly driven by a decrease in Russian and South African supply (Figure 60).

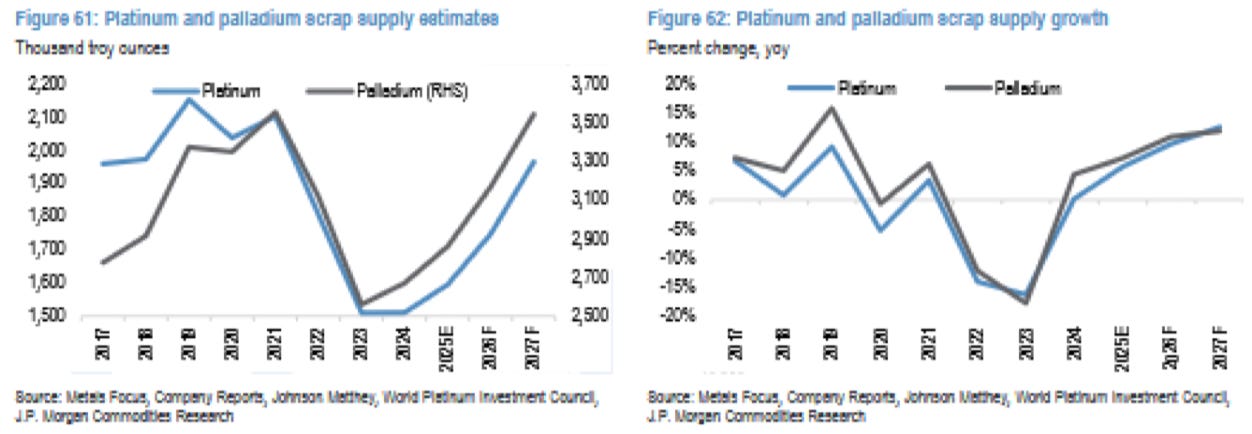

Scrap will do the heavy lifting for supply growth in 2026/27. After a prolonged period of extended vehicle ownership times followed by hoarding by scrap yards waiting for better prices, scrap supply is finally growing again as recyclers are seeing more end-of-life vehicles entering the recycling pipeline. An increase in vehicle scrappage over the next two years, combined with greater incentives to release scrap at higher prices, is expected to further expand the rebound in PGM recycled supply. In turn, scrap growth works to offset a continued fall in platinum and palladium mine supply. Global passenger vehicle sales rose by 5.2% yoy YTD through October, and we expect the momentum in strong vehicle sales this year to continue into 2026, which means older vehicles will be moving to either second-hand car markets or scrap yards. Net-net, this is supportive for PGM autocat recycling. With more vehicles appearing at scrap yards this year, autocat recycling across platinum and palladium is forecasted to be up by 6-7%. Additionally, China's roll out of a scrappage scheme which allows vehicle owners to receive a subsidy when an older ICE vehicle is scrapped to purchase a new electric vehicle has supported autocat recycling in the country this year. For 2026, we see higher scrap processing rates, increased capacity and higher PGM prices driving our forecast for 10% yoy growth in platinum and palladium autocat recycling, with this growth rate expected to further expand in 2027 (Figure 61 & Figure 62).

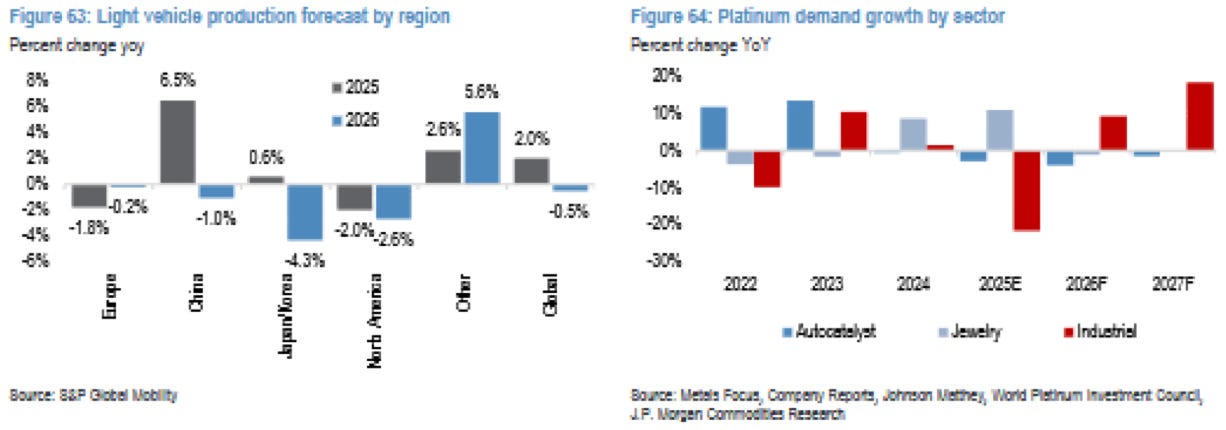

Autocatalyst demand continues to face headwinds. S&P Global forecasts a -0.5% yoy decline in global light vehicle production in 2026 and we expect this to drive a yoy decrease of about 120 k oz and 220 k oz in platinum and palladium autocatalyst demand next year, respectively, as our estimates of catalyst-containing vehicles falls by around 3% yoy (Figure 63). Despite headwinds from auto tariffs in the US earlier this year, global light vehicle production is actually forecast to grow by 2% yoy this year. However, with this growth almost exclusively driven by China where PGM loadings are leaner and BEV share much higher, we forecast autocatalyst demand for platinum and palladium to be down by around 3% yoy this year. 2026 looks challenging too with contractions in light vehicle production expected across all the main regions. Moreover, China's rapid expansion in BEV production and improved sales over the course of this year is accelerating the pace of phasing out ICE vehicles. We see this continuing to weigh on autocat PGM demand going forward, contributing to a -4% yoy decline in platinum next year with palladium autocat demand down by -3% yoy in 2026.

Platinum fabrication demand to recover in 2026/27. After a steep decline in 2025, platinum industrial demand is projected to rise by 9% yoy in 2026. After bottoming out in 2025 following capacity closures in Japan and limited expansions in China, a demand recovery in the cyclical glass industry next year drives the bulk of this growth in industrial demand. Moreover, hydrogen demand is expected to grow steadily over the next few years as the adoption of stationary fuel cells is projected to keep rising, albeit from a low base of only ~50 koz this year. Platinum jewellery fabrication has expanded strongly in 2025 (+11% yoy) as the sharp rise in gold prices widened the price differential between the yellow and white precious metals, driving substitution support. However, we maintain a somewhat cautious stance for 2026 with platinum jewellery demand expected to fall by -1% yoy amid higher sustained prices. All-in-all, after being dragged lower by autocat and industrial demand this year, total fabrication demand for platinum is forecast to rise by ~2% yoy in 2026, and 5% yoy in 2027 driven by a sharp recovery in lumpy industrial demand. In palladium, on the other hand, we see downward pressure on autocat demand next year dragging total fabrication demand lower by about 2% in 2026 (Figure 64).

Source - https://vblgoldfix.substack.com/p/platinum-and-palladium-2026

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.