Deutsche Bank: Gold's Structural Break and the Path Toward USD 5,000

I. Macro Context: Fiscal Saturation and Fiat Risk

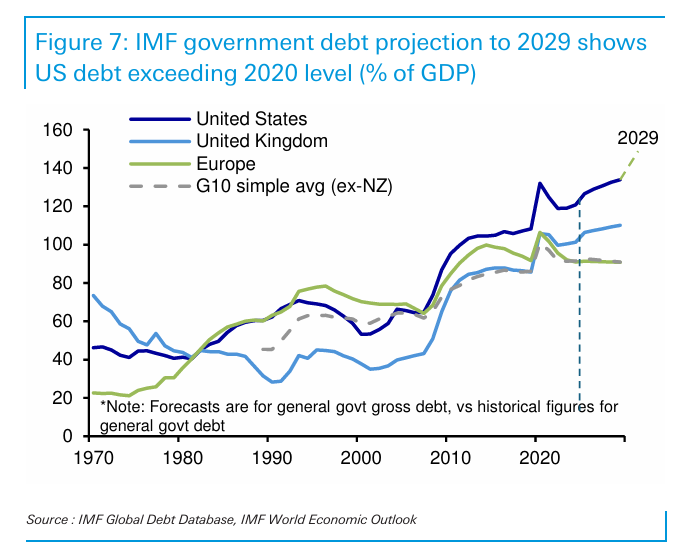

Deutsche Bank frames gold's breakout as the financial manifestation of rising sovereign indebtedness and currency debasement risk. The bank notes that "the implied risks to the value of fiat currency remain embedded in the financial model via US government debt growth and the US dollar," pointing directly to IMF projections that show U.S. government debt continuing to expand through 2029 .

This macro backdrop provides the foundational stressor. Debt saturation limits real yield containment and weakens long-run currency confidence. DB argues that such conditions elevate gold valuations structurally rather than cyclically. The model thus embeds fiat fragility as a baseline support for higher gold prices rather than a tail-risk optionality.

II. Growth of Inelastic Demand as the Dominant Driver

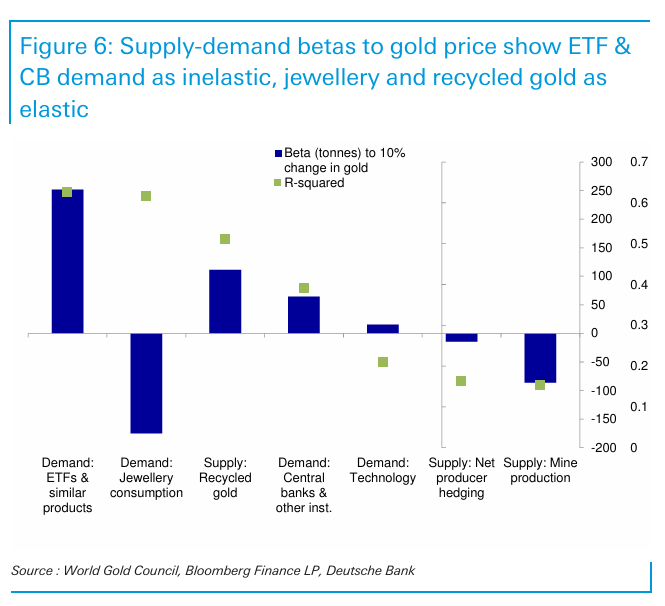

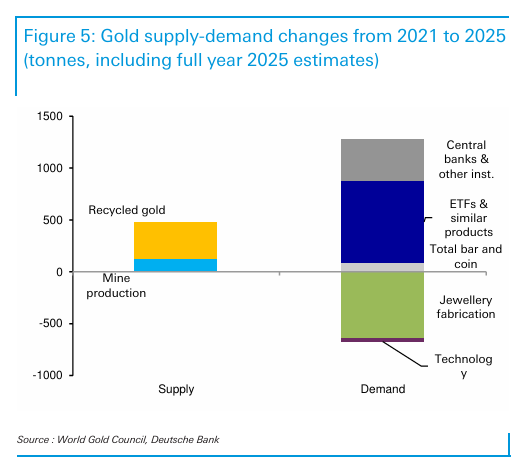

The core of DB's thesis centers on the composition of demand elasticity. Supply-demand betas presented by the bank demonstrate that central-bank purchases and ETF demand exhibit inelastic price sensitivity, whereas jewellery consumption and recycled supply respond elastically to price changes .

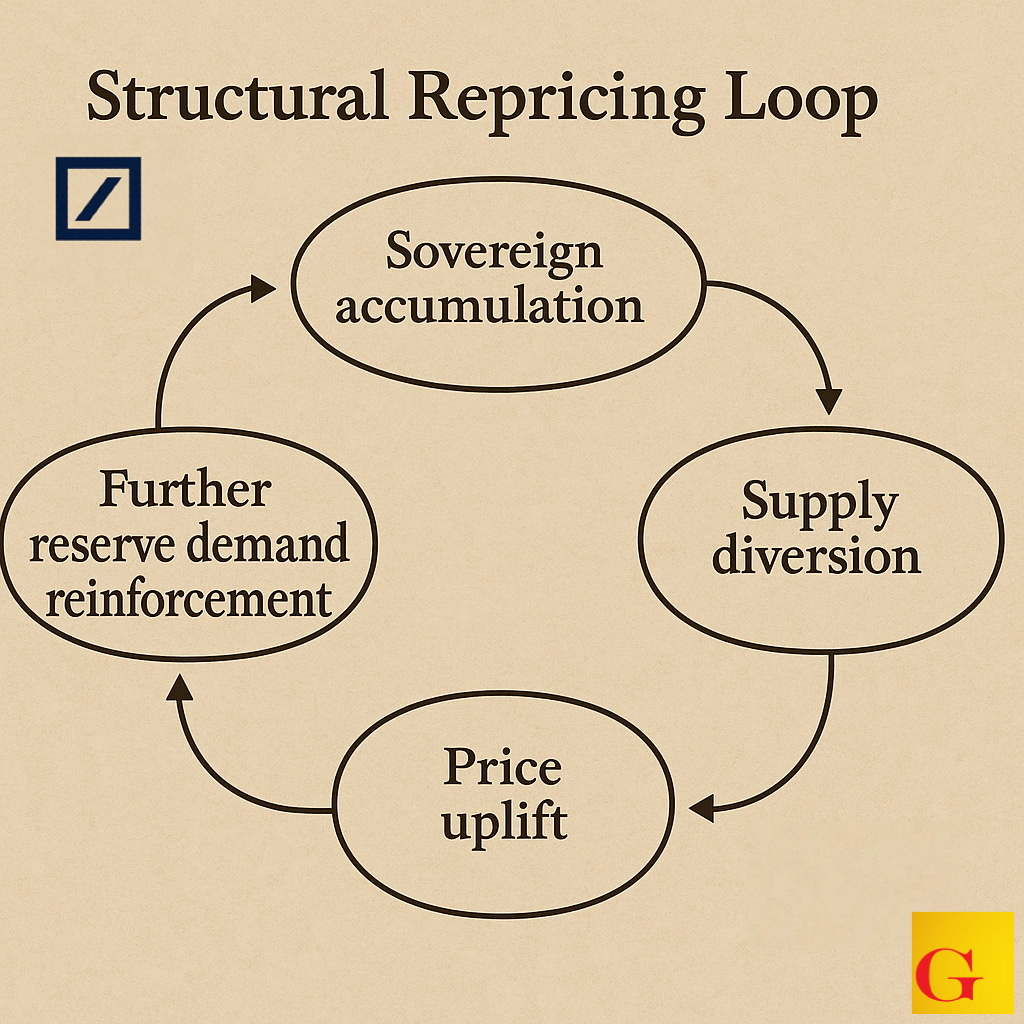

This inversion of traditional gold market mechanics reframes price discovery. Historically, jewellery absorption capped upside during rallies as demand retreated at higher prices. Deutsche Bank's work shows that the price-setting marginal buyer has migrated toward entities indifferent to price sensitivity, principally reserve managers and institutional ETF investors. Supply is therefore being diverted away from elastic channels into structurally sticky demand pools.

The bank summarises this environment directly: "The positive structural picture shows inelastic demand from central banks and ETF investment diverting supply from the jewellery market. Also, overall growth in demand outpaces supply" .

III. Official Sector Accumulation

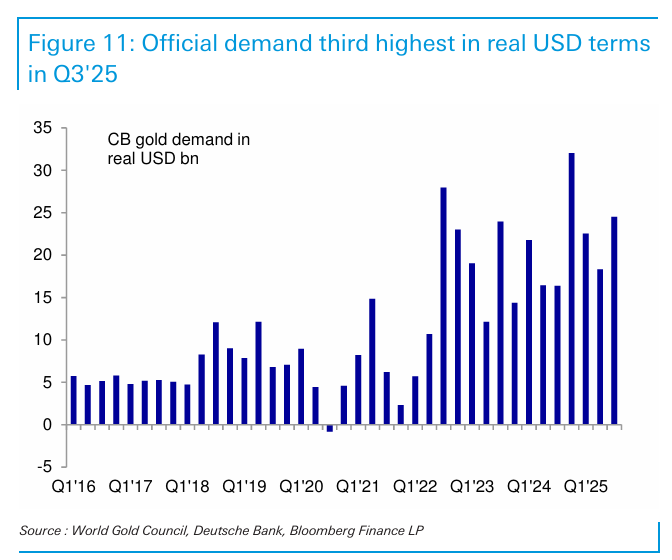

Empirical data supports this structural theme. DB shows official gold demand reaching its third-highest real USD level in Q3 2025 , with cumulative annual purchases projected to rise again following a minor cyclical pause .

The bank quantifies the pricing impact of this trend by indexing post-2021 official purchasing intensity against historical ETF-price regressions. "We have quantified this excess performance by measuring the pace of official demand over the 2011-21 average, and indexing that to a historical ETF-to-gold price regression," DB writes .

This model adjustment is important because it explicitly allows gold to outperform its legacy macro correlations when sovereign accumulation diverges above prior regime baselines. It moves central banks from a secondary flow variable into a dominant price engine.

IV. ETF Flows and the USD 3,900 Floor

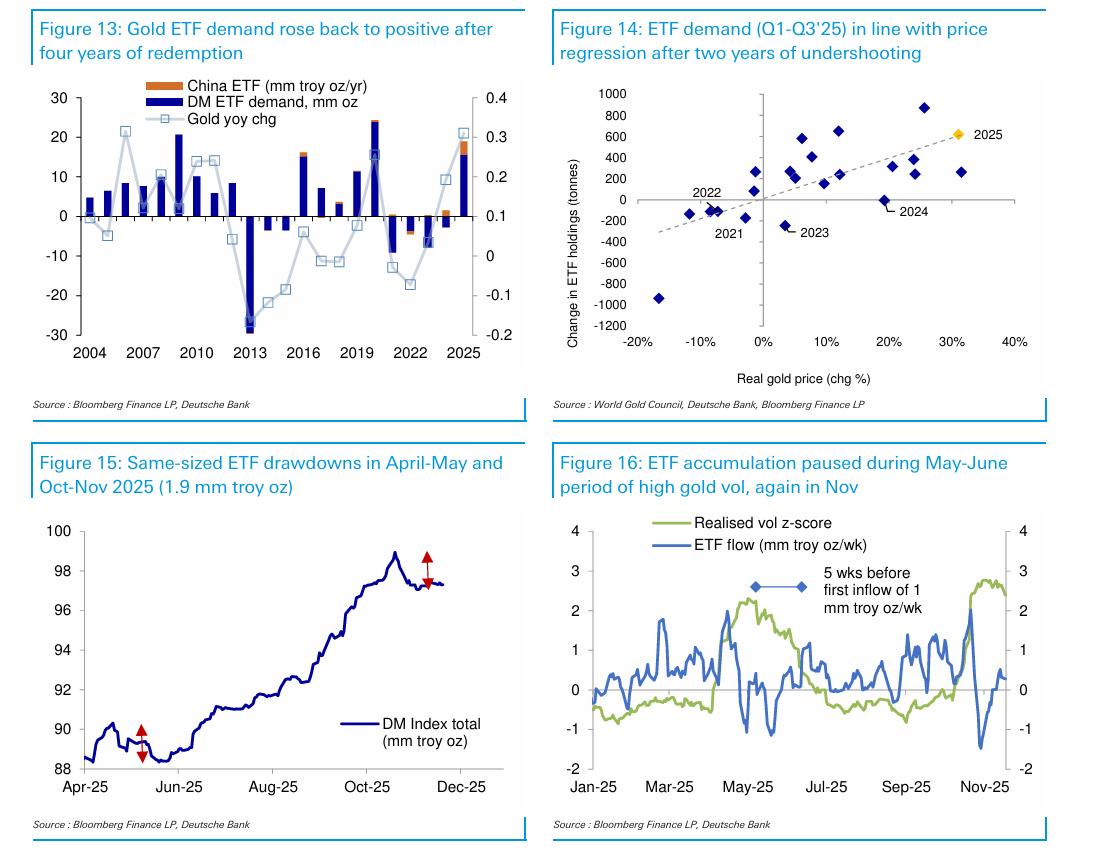

ETF demand plays a secondary but stabilising role. After nearly four years of sustained liquidation, Western ETFs returned to net accumulation across 2025 . DB further observes that selling episodes now lag price impulses rather than leading them. "The largest day of ETF selling took place a full four days after the sharpest daily decline in gold," the bank notes, implying a limited causal role from ETFs in near-term drawdowns .

This observation leads to Deutsche Bank's near-term price boundary. "We think the short and sharp liquidation…suggests that the USD 3,900/oz support will hold," a thesis reinforced by subdued volatility conditions that may leave ETF investors sidelined while official demand substitutes as the primary support mechanism .

V. Jewellery Demand Under Pressure

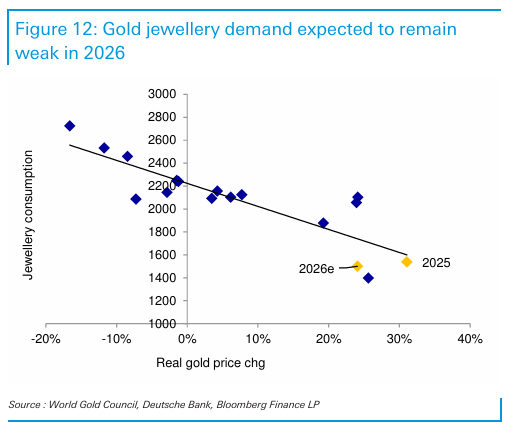

Jewellery consumption, traditionally a stabilizer on both the upside and downside, remains suppressed in DB's outlook. Figure 12 indicates that higher real gold prices continue to constrain jewellery consumption into 2026 .

This dynamic paradoxically reinforces bullish structural conditions. Weak jewellery demand removes a volatility buffer but also prevents demand substitution away from inelastic buyers. Prices become less anchored to retail affordability metrics and more responsive to institutional balance-sheet demand.

VI. Supply Dynamics: Limited Elasticity

On the supply side, DB finds that mine output continues to expand only modestly, while recycled supply remains below historical peaks. Beta analysis confirms supply sources respond weakly to price movements compared to demand sectors .

This muted supply elasticity compounds the demand distortion. Structural inflows into official reserves are not met with proportionate increases in production or scrap recovery, creating persistent imbalance risk that can only resolve via price adjustment.

VII. Forecast Upgrade and Targets

Based on these interlocking drivers, Deutsche Bank revised its gold outlook meaningfully. "These factors argue for an upgrade to our 2026 forecast towards USD 4,450/oz from USD 4,000/oz previously, and a yearly range from USD 3,950-4,950/oz in 2026. A high of USD 4,950/oz would be a premium of 14% over current Dec'26 GC futures," the report states .

This upgrade reflects the bank's conclusion that gold has entered a regime of above-model price growth driven by official buying divergences rather than cyclical rate-cut expectations.

VIII. Risk Framework

Deutsche Bank remains explicit on downside contingencies. The bank identifies equity market drawdowns as potentially damaging due to gold's positive correlation with risk assets in certain regimes, along with its expectation for less Federal Reserve easing than current market pricing assumes in 2026. Geopolitical normalization, including a negotiated end to the Russia-Ukraine conflict, is described as a temporary negative, though longer-term reserve diversification trends remain the dominant variable .

IX. Strategic Synthesis

Deutsche Bank's work formalizes a macro reclassification of gold:

Price is no longer driven primarily by speculative or jewellery elasticity.

Inelastic institutional demand is now the dominant marginal buyer class.

Supply lacks adequate adaptive response.

Fiscal saturation embeds ongoing currency debasement risk into valuation models.

Taken together, DB's thesis implies that the conventional gold cycle has shifted to a policy-driven accumulation regime more consistent with structural repricing than volatility-mean reversion. Their near-USD 5,000 upside scenario does not depend upon aggressive ETF inflows or acute inflation resurgence but rather on persistence in official sector accumulation against constrained incremental supply.

Bottom Line:

Gold, under DB's analysis, is repricing not because of speculative enthusiasm but because its ownership base has evolved from discretionary buyers to balance-sheet actors. This transition, visible across official hoarding patterns and ETF normalization, establishes a durable bid floor around USD 3,900 while leaving upside torque intact.

In regime terms: the floor is raised and the roof is raising.

Volatility compression at ETF levels stabilizes downside.- as broken out in their prior analyses here

Central-bank accumulation anchors demand irreversibly.- CBs are not price elastic now also detailed in prior DB pieces and submitted here.

Supply responses remain insufficient to cap price drift.- leasing collateral and new gold is not available

Within this framework, Deutsche Bank's USD 4,450 base forecast and USD 4,950 upper-band scenario function less as cyclical extremes and more as stepping stones within a longer structural repricing arc.

The DB Silver breakdown is titled DB: Silver (and Platinum) Crash Gold's Party in 2026

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

Augusta Precious Metals — Named “Best Overall” by Money Magazine and trusted by high-net-worth investors. Augusta specializes in premium IRA and 401(k) rollovers, offering direct access to educational 1:1 web conferences and U.S. Mint-approved gold and silver.

- Minimum Investment: $50,000

- Fees: $0 storage up to 10 years

- Rating: ★★★★★ (A+ BBB, AAA BCA)

Goldco — With over $2 billion in precious metals placed for customers, Goldco is a leading name in Gold & Silver IRAs and direct bullion purchases. Known for its strong buyback program and industry awards, Goldco offers both IRA and non-IRA investments.

- Minimum Investment: $25,000

- Buyback Guarantee: Yes

- Rating: ★★★★☆ (A+ BBB, AAA BCA)

American Hartford Gold — Ranked #1 Gold Company on Inc. 5000, endorsed by Bill O’Reilly and Rick Harrison. AHG offers flexible IRA rollovers and direct gold & silver purchases, serving over $2B in precious metals to clients nationwide.

- Minimum Investment: $10,000

- Endorsements: Bill O’Reilly, Rick Harrison

- Rating: ★★★★☆ (A+ BBB)

Content quality approved by JPost. JPost oversees the native, paid, and sponsored content on this website and guarantees quality, relevance, and value for the audience. However, articles attributed to this byline are provided by paying advertisers and the opinions expressed in the content do not necessarily express the opinions of JPost.The sponsor retains the responsibility of this content and has the copyright of the material. For all health concerns, it is best to seek the advice of your doctor or a legal practitioner.